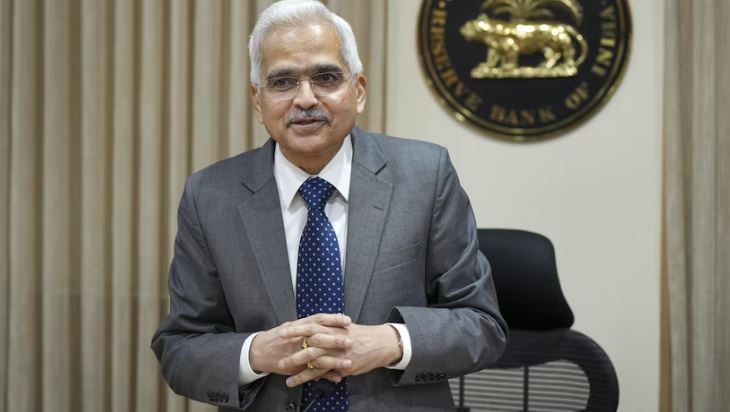

Bengaluru – August 29, 2024: For India@100 Shri Shaktikanta Das, Governor, Reserve Bank of India proposed five priorities for the future of the financial system: 1) financial inclusion, 2) digital public infrastructure, 3) consumer protection and cyber security, 4) sustainable finance and 5) global integration and co-operation. “This journey will be marked by dynamic shift in technology, regulation, geopolitics and growing societal expectations. It is up to the stakeholders in the Indian financial ecosystem to foster economic resilience,” said Shri Das, speaking at the Global Fintech Fest 2024 here today.

Global Fintech Fest (GFF) 2024 is presented by the Ministry of Electronics and Information Technology (MeitY), the Ministry of External Affairs, the Department of Financial Services (DFS), the Reserve Bank of India (RBI) and the International Financial Services Centres Authority (IFSCA). The conference is jointly organised by the Payments Council of India (PCI), the National Payments Corporation of India (NPCI), and the Fintech Convergence Council (FCC).

In his keynote address, Shri Das said, “India is a fast-growing economic powerhouse with an increasingly tech-savvy population. India’s financial sector has witnessed a remarkable transformation driven by the fintech sector. Publicly available information places the number of fintechs founded in India at approximately 11,000, and the fintech sector has received investments of about USD 6 billion in the last two years alone.” The Governor proposed to highlight three major aspects: First, setting the priorities for India at 100. Second, technologies for the future and third, the regulatory architecture for fintechs.

Welcoming the RBI Governor, Mr. Kris Gopalakrishnan, Chair – GFF2024, Co-founder Infosys and Chairman, Axilor Ventures said, “The role of a regulator is enabling and enforcing, as without enabling, enforcement is not possible. I believe that RBI has done a fantastic job of working with the industry and making innovation possible and creating an economy that is inclusive, equitable and that is driven by technology.”

Around 800 speakers, including policymakers, regulators, senior bankers, industry captains, and academicians, from India and various other countries are addressing more than 350 sessions over three days of the conference. Delegates have arrived from around a hundred countries, besides India.